Popular 1oz Sovereign Minted Gold Bullion Coinage

Popular 1oz Privately Minted Gold Bars

-

1 OZ GOLD BAR .999 FINE (Various Brand and Design)$2,385.80

1 OZ GOLD BAR .999 FINE (Various Brand and Design)$2,385.80 -

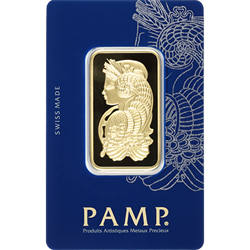

1 OZ GOLD BAR PAMP FORTUNA$2,428.80

1 OZ GOLD BAR PAMP FORTUNA$2,428.80 -

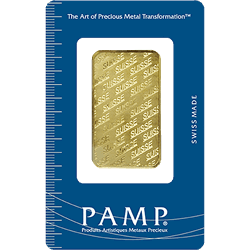

1 OZ GOLD BAR PAMP .9999 FINE$2,415.30

1 OZ GOLD BAR PAMP .9999 FINE$2,415.30 -

1 OZ GOLD BAR PERTH$2,397.80

1 OZ GOLD BAR PERTH$2,397.80 -

1 OZ GOLD BAR VALCAMBI$2,396.30

1 OZ GOLD BAR VALCAMBI$2,396.30

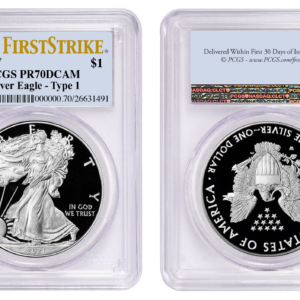

Certified Sovereign Silver

Sovereign Silver Bullion