New York Fed Adds Another $97.9 Billion In Liquidity Yesterday – Concerns Grow of Year-End Financial Crisis

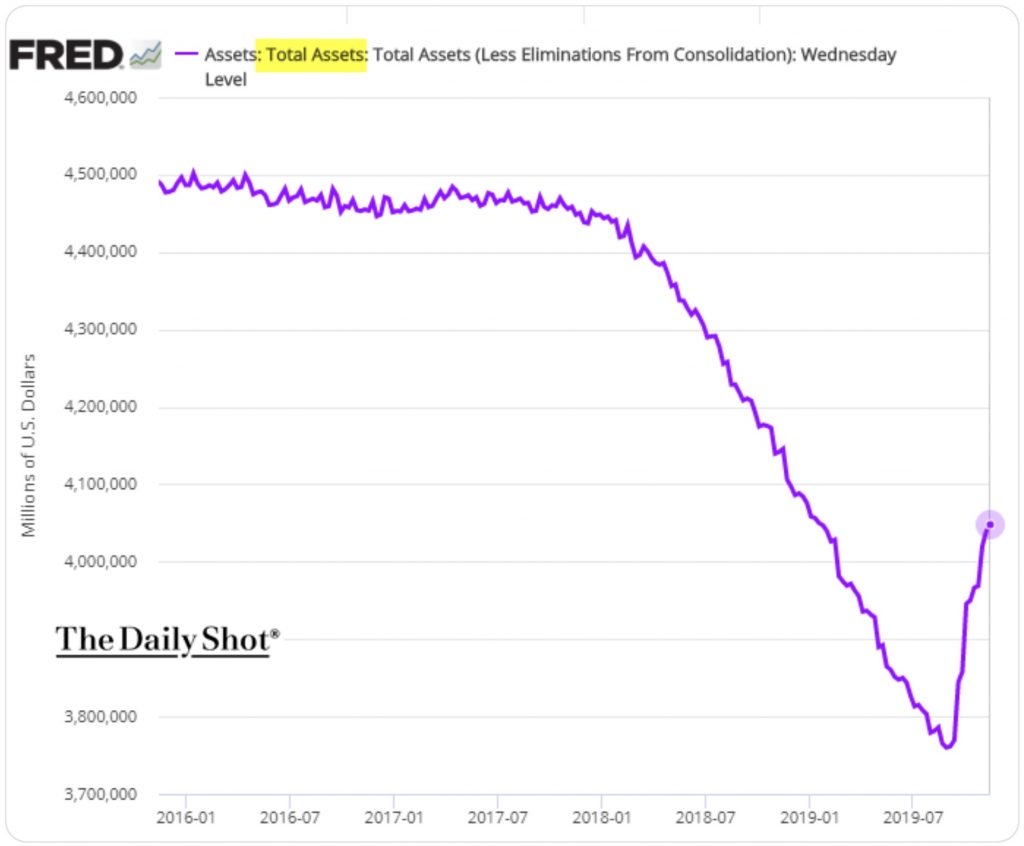

40% Of Fed’s Balance Sheet Reduction Wiped Out In Just 2 Months

◆ The New York Fed added $97.9 billion in temporary liquidity to the financial system yesterday.

◆ The Federal Reserve Bank of New York continues to pump massive liquidity amid very heavy demand by banks for year-end funding; the $97.9 billion involved overnight repurchase agreements, or repos, worth $72.9 billion and the balance via 42-day repos.

◆ The repo market shook the financial world in September when an unexpected rate spike choked short-term lending, spurring the Federal Reserve to intervene.

◆ Interventions ensure markets have enough liquidity and short-term borrowing rates do not spike violently and create a liquidity crisis on Wall Street and the global financial system.

◆ The New York Fed has now pumped nearly $3 trillion into unnamed trading houses on Wall Street in just over two months to ease a liquidity crisis that has yet to be credibly explained.

◆ Massive currency injections signal there are significant problems in the plumbing of the interbank lending market and wider financial system