Category: Market News

Case For Holding Gold – The Lombard Odier View

Tom Burroughes, Group Editor , London, 22 July 2020

The Swiss private bank sets out the reason for holding the yellow precious metal in portfolios. The commentary is another turn in the debate about the role gold should play in wealth management.

The case for gold often arises when risks appear to be higher than normal, or when fears erupt that the value of government “fiat” money is going to erode. Massive central bank quantitative easing – aka money printing – and the impact of the global pandemic create plenty of risks in the investor’s mind, even if it turns out that central bank new money gets mopped up before problems arise. This is a classic “safe haven” asset. Debate remains: the very time that a person might want to access their gold might be a time when governments try to seize it – as happened during the 1930s in the US.

Gold Is Dangerously Under-owned by Americans, Especially Now Gold Is Dangerously Under-owned by Americans, Especially Now

Far from being mired in the summer doldrums, precious metals markets appear to be on their way to making this summer one for investors to celebrate. $20+ silver and new record highs for gold are both well within reach.

Even as the big tech stocks that make up the Nasdaq are posting rip-roaring gains, the best performing sector of 2020 has actually been the gold miners. The HUI gold mining stock index is up 30% year to date – and up over 90% since bottoming in March.

Investors who bought just about any stock market sector near the climax of the panic selling have since been able to make big gains. But valuations are now becoming stretched while the earnings picture for most companies remains shaky.

Perhaps equities will be able to ride the rising tide of liquidity provided by the Federal Reserve to still higher heights. But Michael Howell, the CEO of Crossborder Capital, urged CNBC International viewers to consider diversifying into gold.

READ MORE

Goldman Sachs has a new blowout forecast for gold

Critical information for the U.S. trading day

A weaker day is setting up for stocks on Tuesday, as optimism over U.S. stimulus progress and vaccine news starts to fade, and attention turns to the start of a two-day Federal Reserve meeting.

The asset that stole the show on Monday, of course, was gold GCQ20, 0.69%, which climbed to $1,931 an ounce, the highest settlement in history. That juiced the crowd expecting $2,000 an ounce soon, and leads us to our call of the day from Goldman Sachs, which has ditched its own $2,000 forecast and says we’re going to see $2,300 an ounce in the next 12 months.

The bank also lifted its silver outlook to $30 from $22 an ounce.

Driven by “a potential shift in the U.S. Fed toward an inflationary bias against a backdrop of rising geopolitical tensions, elevated U.S. domestic political and social uncertainty, and a growing second wave of COVID-19 related infections,” gold’s surge to new highs lately has outpaced gains for real rates and other alternatives to the dollar, said a team of analysts led by Jeffrey Currie.

“Combined with a record level of debt accumulation by the U.S. government, real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge,” said the team.

Merrill Lynch Caught Criminally Manipulating Precious Metals Market “Thousands Of Times” Over 6 Years

Remember when it was pure tinfoil-hat conspiracy theory to accuse one or more banks of aggressively, compulsively and systematically manipulating the precious metals – i.e., gold and silver – market? We do, after all we made the claim over and over, while demonstrating clearly just how said manipulation was taking place, often in real time.

Well, it’s always good to be proven correct, even if it is years after the fact.

On Tuesday after the close, the CFTC announced that Merrill Lynch Commodities (MLCI), a global commodities trading business, agreed to pay $25 million to resolve the government’s investigation into a multi-year scheme by MLCI precious metals traders to mislead the market for precious metals futures contracts traded on the COMEX (Commodity Exchange Inc.). The announcement was made by Assistant Attorney General Brian A. Benczkowski of the Justice Department’s Criminal Division and Assistant Director in Charge William F. Sweeney Jr. of the FBI’s New York Field Office. In other words, if the Merrill Lynch Commodities group was an individual, he would have gotten ye olde perp walk.

As MLCI itself admitted, beginning in 2008 and continuing through 2014, precious metals traders employed by MLCI schemed to deceive other market participants by injecting materially false and misleading information into the precious metals futures market.

They did so in the now traditional market manipulation way – by placing fraudulent orders for precious metals futures contracts that, at the time the traders placed the orders, they intended to cancel before execution. In doing so, the traders intended to “spoof” or manipulate the market by creating the false impression of increased supply or demand and, in turn, to fraudulently induce other market participants to buy and to sell futures contracts at quantities, prices and times that they otherwise likely would not have done so. Over the relevant period, the traders placed thousands of fraudulent orders.

Of course, since we are talking about a bank, and since banks are in charge of not only the DOJ, and virtually every other branch of government, not to mention the Fed, nobody will go to jail and MLCI entered into a non-prosecution agreement and agreed to pay a combined – and measly – $25 million in criminal fines, restitution and forfeiture of trading profits.

Under the terms of the NPA, MLCI and its parent company, Bank of America, have agreed to cooperate with the government’s ongoing investigation of individuals and to report to the Department evidence or allegations of violations of the wire fraud statute, securities and commodities fraud statute, and anti-spoofing provision of the Commodity Exchange Act in BAC’s Global Markets’ Commodities Business, whose function is to conduct wholesale, principal trading and sales of commodities. Laughably, MLCI and BAC also agreed to enhance their existing compliance program and internal controls, where necessary and appropriate, to ensure they are designed to detect and deter, among other things, manipulative conduct in BAC’s Global Markets Commodities Business.

Translation: it will be much more difficult to catch them manipulating the market next time.

The Department reached this resolution based on a number of factors, including MLCI’s ongoing cooperation with the United States – which means the DOJ must have had the bank dead to rights with many traders potentially ending up in jail – and MLCI and BAC’s remedial efforts, including conducting training concerning appropriate market conduct and implementing improved transaction monitoring and communication surveillance systems and processes. Translation – no longer boasting about market manipulation on semi-public chatboards.

The Commodity Futures Trading Commission also announced a separate settlement with MLCI today in connection with related, parallel proceedings. Under the terms of the resolution with the CFTC, MLCI agreed to pay a civil monetary penalty of $11.5 million, along with other remedial and cooperation obligations in connection with any CFTC investigation pertaining to the underlying conduct.

As part of the investigation, the Department obtained an indictment against Edward Bases and John Pacilio, two former MLCI precious metals traders, in July 2018. Those charges remain pending in the U.S. District Court for the Northern District of Illinois.

This case was investigated by the FBI’s New York Field Office. Trial Attorneys Ankush Khardori and Avi Perry of the Criminal Division’s Fraud Section prosecuted the case. The CFTC also provided assistance in this matter.

Oh, and for anyone asking if they will get some of their money back for having been spoofed and manipulated by Bank of America, and countless other banks, into selling to buying positions that would have eventually made money, the answer is of course not.

Courtesy of ZeroHedge by Tyler Durden from Wed, 06/26/2019

World’s Largest Hedge Fund Sees Gold Rising 30% To $2,000

◆ Bridgewater’s co-chief investment officer Greg Jensen told the Financial Times that gold prices could rally to $2,000 an ounce.

◆ The manager from the world’s biggest hedge fund cited increased income inequality in the U.S. and rising tensions with China and Iran as uncertainties that will prompt more safe-haven buying.

◆ Jensen also believes the Federal Reserve would let inflation run hot for a while, which also creates an environment for higher gold prices.

◆ Spot gold now trades at $1,551.40 per ounce, after crossing the $1,600 mark and hitting a seven-year high last week

FT via CNBC

Gold prices, which briefly topped $1,600 last week, could rally to $2,000 an ounce amid heightened political risks, Bridgewater’s co-chief investment officer Greg Jensen told the Financial Times Wednesday.

The manager from the world’s biggest hedge fund cited increased income inequality in the U.S. and rising tensions with China and Iran as uncertainties ahead that will prompt more safe-haven buying. Bridgewater manages $160 billion in assets, more than any other hedge fund.

“There is so much boiling conflict,” Jensen told the paper. “People should be prepared for a much wider range of potentially more volatile set of circumstances than we are mostly accustomed to.”

Jensen also believes the Federal Reserve would let inflation run hot for a while, which also creates an environment for higher gold prices as investors tend to use the precious metal as a hedge against inflationary forces.

Spot gold rose 0.3% to $1,551.40 per ounce on Wednesday, after crossing the $1,600 mark and hitting a seven-year high last week. The U.S.-China trade war and the Middle East unrest drove investors to more conservative investments for its stability during times of tumult, pushing gold prices higher.

Earlier last year, founder of Bridgewater Ray Dalio advocated putting money into gold as he saw a “paradigm shift” in investing due to global central banks’ expected moves to an easier monetary policy.

The Federal Reserve cut interest rates for three times last year to combat a slowing economy. Jensen said it’s possible the central bank could slash rates to zero this year to avoid a recession and disinflationary pressures.

Bridgewater is not alone in recommending gold bullion. DoubleLine CEO, Jeffrey Gundlach also said last year he was a buyer of gold on expectations that the dollar would weaken.

Why is this billionaire predicting gold could hit $5,000?

You can add another billionaire to the bullish gold camp as Thomas Kaplan, chairman and chief investment officer of Electrum Group said in a recent interview with Bloomberg that gold is on the cusp of a new decade long bull market.

In a preview clip of the interview Kaplan, who is also chairman of Novagold Resources (NYSE: NG, TSX: NG) said that because of economic fundamentals gold prices could rally as high as $3,000 to $5,000 within a decade.

Kaplan told Rubenstein he sees two possible scenarios for the yellow metal.

In the first, gold has already broken out and, as Jeff Gundlach puts it, “is coiling like a snake for its next move to take on the old highs.”

In the second scenario, gold could take one more head-fake to the downside, “just to shake out the weak hands.”

But then I do believe gold embarks on the next leg of its bull market and goes past $1,900 and ultimately $3,000 to $5,000, if not a lot higher, depending on macro circumstances that today seem dim but I can’t really quantify.”

Rubenstein asked how long he would have to wait to see that price level. Kaplan said he usually measures these kinds of moves in decades.

The first move, the first leg in gold took gold from $250 to $1,900. For 12 consecutive years, gold was up every single year whether there were inflation fears or deflation fears, strong dollar, weak dollar, political stability, political instability. It didn’t matter. Strong oil, weak oil. Didn’t matter. Gold went up for 12 years. That to me is a bull market. We’ve now been in a correction which has taken gold from $1,900 back to where we are today. You could easily see gold fall a couple of hundred dollars before going up a couple of thousand dollars. But each move has been a decade or more, which means that when gold embarks upon its next move, I believe that you will see that long wave take gold relatively quickly, but it will be measured in years, to the three to five thousand dollar target that I believe is fundamentally justified based on the facts that we have today.”

Kaplan is not the only billionaire investor to project an upcoming gold bull market. Earlier this month, SEC filings showed that Ray Dalio has increased his position in gold. During the Sohn Investment Conference, Jeff Gundlach said, “I love gold. I have owned gold since it was trading at $300.” And David Einhorn, founder of Greenlight Capital told Kitco News, “I hold gold, and I am never going to get rid of it. I hope that I never have to use it.

Kaplan is just the latest fund manager to jump on the gold bandwagon. Earlier this month, SEC filings showed that Ray Dalio’s hedge fund Bridgewater Associates increased its holdings in both SPDR Gold Shares (NYSE: GLD) and iShares Gold Trust (NYSE: IAU) in the first quarter of 2019.

This excerpt is from an original article published by Bloomberg.com on May 29, 2019

Jay Taylor: Under “Basel III” Rules, Gold Becomes Money!

Courtesy of ZeroHedge

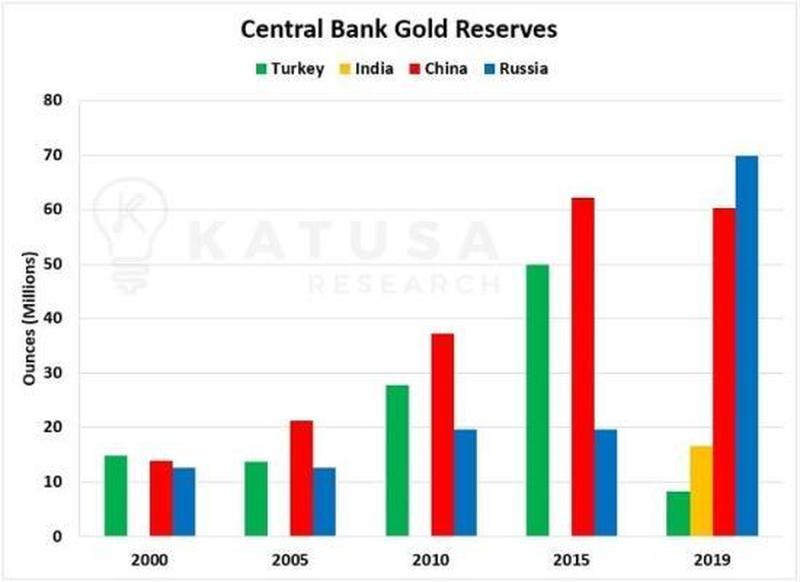

In 2018, central banks added nearly 23 million ounces of gold, up 74% from 2017. This is the highest annual purchase rate increase since 1971, and the second-highest rate in history. Russia was the biggest buyer. And not surprisingly, the lion’s share of gold is flowing into central banks of countries that are in the sights of America’s killing machine—the Military Industrial Complex that Eisenhower warned us about in 1958.

The Bank for International Settlements (BIS), located in Basal, Switzerland, is often referred to as the central bankers’ bank. Related to this issue of central bank hoarding of gold is the fact that on March 29 the BIS will permit central banks to count the physical gold it holds (marked to market) as a reserve asset just the same as it allows cash and sovereign debt instruments to be counted.

There has been a long-term view that China and other nations dishoarding dollars in favor of gold have been quite happy about western banks trashing the gold price through the synthetic paper markets. But one has to wonder if that might not change, once physical gold is marked to market for the sake of enlarging bank balance sheets.

This also raises the question with regard to how much gold the U.S. actually holds as opposed to what it claims to hold. James Sinclair has always argued that the only way the world can overcome the debt that is strangling the global economy is to remonetize gold on the balance sheets of central banks at a price in many thousands of dollars higher. This would mean a major change in the global monetary system away from the dollar, as China has been pushing for the last decade or so.

If banks own and possess gold bullion, they can use that asset as equity and thus this will enable them to print more money. It may be no coincidence that as March 29th has been approaching banks around the world have been buying huge amounts of physical gold and taking delivery. For the first time in 50 years, central banks bought over 640 tons of gold bars last year, almost twice as much as in 2017 and the highest level raised since 1971, when President Nixon closed the gold window and forced the world onto a floating rate currency system.

But as Chris Powell of GATA noted, that in itself is not news. The move toward making gold equal to cash and bonds was anticipated several years ago. However, what is news is the realization by a major Italian Newspaper, II Sole/24 Ore, that “synthetic gold,” or “paper gold,” has been used to suppress the price of gold, thus enabling countries and their central banks to continue to buy gold and build up their reserves at lower and lower prices as massive amounts of artificially-created “synthetic gold” triggers layer upon layer of artificially lower priced gold as unaware private investors panic out of their positions.

The paper concludes that,

“In recent years, but especially in 2018, a jump in the price of goldwould have been the normal order of things. On the contrary, gold closed last year with a 7-percent downturn and a negative financial return. How do you explain this? While the central banks raided “real” gold bars behind the scenes, they pushed and coordinated the offer of hundreds of tons of “synthetic gold” on the London and New York exchanges, where 90 percent of the trading of metals takes place. The excess supply of gold derivatives obviously served to knock down the price of gold, forcing investors to liquidate positions to limit large losses accumulated on futures. Thus, the more gold futures prices fell, the more investors sold “synthetic gold,” triggering bearish spirals exploited by central banks to buy physical gold at ever-lower prices”.

The only way governments can manage the levels of debt that threaten the financial survival of the Western world is to inflate (debase) their currencies. The ability to count gold as a reserve from which banks can create monetary inflation is not only to allow gold to become a reserve on the balance sheet of banks but to have a much, much higher, gold price to build up equity in line with the massive debt in the system.

by Tyler Durden Sun, 03/17/2019 – 11:29

Excepted from Jay Taylor’s latest newsletter

Gold Strategy

Investors continue to find the Equity markets attractive even with no end in sight to the China and Brexit negotiations.

With investors feeling confident that their investments are in good shape, safe haven investments like Gold and Bonds can be overlooked at this time.

But let us not forget that in 2018 market sentiment flipflopped back and forth daily between “Risk-On” and “Risk-Off” ideology. Every day we continue to see risk in the headlines, whether geopolitical or economic, anything can happen in a moment that will turn markets around. Not to mention the continued ongoing political rumor mill here in the States.

These headlines can take a toll on a trader and investors’ emotions, but can also provide opportunities.

That’s where a Dollar Gold cost averaging strategy can make a lot of sense. When the price of Gold declines, many smart Gold investors see it as a buying opportunity to create a truly balanced portfolio.

At the time of this report, Equity markets are called up over two hundred points. So, when the price of Gold is most ignored by investors that might be the best time to, so to speak, “put your toe in the water” and put in place your dollar cost averaging strategy.

Palladium

Palladium prices have experienced a much-needed correction in the past week and may be vulnerable to further declines in the short term. Despite this continued tightness in supply the market is likely to see prices test higher across the medium to longer term.

To back up that philosophy, Johnson Matthey estimates that the Palladium supply deficit could reach one million ounces in 2019. So maybe there still significant room to the upside in the price.

Today’s Palladium EFP is quoted by some dealers at Minus 40 minus 20. If the EFP stays in negative territory higher prices are always a possibility.

Originally published April 1, 2019

How Long Will It Take For The US To Collapse?

Courtesy of Alt-Market by Brandon Smith

There are a multitude of false assumptions out there on what the collapse of a nation or “empire” looks like. Modern day Americans have never experienced this type of event, only peripheral crises and crashes. Thanks to Hollywood, many in the public are under the delusion that a collapse is an overnight affair. They think that such a thing is impossible in their lifetimes, and if it did happen, it would happen as it does in the movies – They would simply wake up one morning and find the world on fire. Historically speaking, this is not how it works. The collapse of an empire is a process, not an event.

This is not to say that there are not moments of shock and awe; there certainly are. As we witnessed during the Great Depression, or in 2008, the system can only be propped up artificially for so long before the bubble pops. In past instances of central bank intervention, the window for manipulation is around ten years between events, give or take a couple of years. For the average person, a decade might seem like a long time. For the banking elites behind the degradation of our society and economy, a decade is a blink of an eye.

In the meantime, danger signals abound as those analysts aware of the situation try to warn the populace of the underlying decay of the system and where it will inevitably lead. Economists like Ludwig Von Mises foresaw the collapse of the German Mark and predicted the Great Depression; almost no one listened until it was too late. Multiple alternative economists predicted the credit crisis and derivatives crash of 2008; and almost no one listened until it was too late. People refused to listen because their normalcy bias took control of their ability to reason and accept the facts in front of them.

There are a number factors that cause mass blindness to economic and social reality. First and foremost, establishment elites deliberately create the illusion of prosperity by rigging economic data to the upside. In almost every case of economic crisis or geopolitical disaster, the public is conditioned to believe they are in the midst of a financial “boom” or era of “peace”. They are encouraged to ignore fundamental warning signs in favor of foolish faith in the system. Those people that try to break the apathy and expose the truth are called “chicken little” and “doom monger”.

In the minds of the cheerful lemmings a “collapse” is something very obvious; they think they would know it when they saw it. It’s like trying to teach a blind person about colors; it’s not impossible, but it’s very difficult to get all these Helen Kellers to understand that what they perceive is not the whole reality. There’s a vast world hidden from them and they have no concept of how to observe it.

Crash events are like stages in the process of collapse; they create moments of clarity for the blind. However, they are also often engineered to benefit the establishment. There’s a reason why the elites put so much energy into hiding the real data on the state of the economy, and it’s not because they are trying to keep the system from faltering by using sheer public ignorance. Rather, a crash event is a tool, a means to an end. As Congressman Charles Lindbergh Sr. warned after the panic of 1920:

“Under the Federal Reserve Act, panics are scientifically created; the present panic is the first scientifically created one, worked out as we figure a mathematical problem…”

Central bankers and their cohorts manipulate economic data and promote the false notion of a boom before almost every major crash because they WANT to ambush the populace. They WANT to create panic, and then use it to their advantage as they rebuild and mutate the system into something unrecognizable only decades ago. Each consecutive crash contributes to the collapse of the whole, until eventually the society we once had is barely a distant memory.

This process can take decades, and the US has been subject to it for quite some time now. Once again in 2019 we are seeing the lie of an “economic boom” being perpetuated in the mainstream. The public was growing too aware of the danger and had to be subdued. More specifically, conservatives were growing too aware. The sad thing is that the boom propaganda is most prominent today among conservatives, who are desperately trying to ignore the fundamentals in an attempt to defend the Trump Administration.

The same people who were pointing out the economic bubble under Obama are now denying its existence under Trump. Trump himself argued that the markets were a dangerous economic fraud created by the Federal Reserve during his campaign, yet once he was in office he flip-flopped and started taking full credit for the bubble. What is mind boggling to me is that many people, even in the liberty movement, still choose to dismiss this behavior in favor of worshiping Trump as some kind of hero on a white horse.

This only reinforces my theory that the system is due for another major engineered crash event, and that the ongoing collapse of the US is soon to accelerate. Each case of economic calamity in modern history was preceded by peak delusional optimism and peak greed. When the people traditionally most vigilant against crisis suddenly capitulate and claim victory, this is when reality strikes hardest. This is when the establishment triggers yet another controlled demolition.

In order to determine how long an empire will last, one has to take into account the agenda of the elites that control its institutions. As long as they are in key positions of power within the system and as long as they can inject their own puppet politicians, they will have the ability to influence the collapse timeline of that system.

Can they prolong and stave off crisis? Yes, for a short while. However, once the machine of a crash has been set in motion the best they can do is slow down the Titanic; they cannot change its path towards the iceberg. And frankly, at this point why would they? I hear it argued often that the elites are going to “keep the plates spinning” on the economy and that they don’t want to lose their “golden goose” in the US economy. This reveals an naivety among skeptics of the true agenda.

Firstly, the elites have a highly useful political puppet in the form of Donald Trump; he is useful in that he inspires sharp national division, and, he is a self proclaimed conservative champion and nationalist. If the elites did not trigger a crash under Trump, then this would give the public the impression that conservative ideals and national sovereignty works. This is the opposite of what they want. Why would globalists that want the erasure of nation states and the creation of a centralized socialist “Utopia” seek to make conservatives and nationalists look good? Well, they wouldn’t.

The only concern of the banks is that they do not take the blame as their engineered collapse of the old world order hits the public with increasingly painful consequences. These consequences are already becoming visible.

The next major crash has begun in the form of plunging fundamentals, and far too many conservatives are placing their heads in the sand for the selfish sake of proving the political left wrong. Declines in US manufacturing, US freight, global exports and imports, mass closures in US retail, as well as all time highs in consumer debt, corporate debt and national debt are being shrugged off and rationalized as nothing more than “hiccups” in an otherwise booming economy. The Fed’s repo market purchases, barely keeping up with demand from liquidity starved corporations are also not being taken seriously.

Conservatives and analysts are going to have to forget about supporting Trump, a Rothschild owned proxy, and start acknowledging reality once again. The only question now is, will the elites allow the crash to spread further into mainstreet and strike markets before or after the 2020 election?

As noted above, to predict the timing of a collapse in a nation or empire, one has to examine the agendas of the elites that dominate its institutions. We can gain some sense of timing from the public admissions of globalist organizations like the IMF and the UN. Each has announced the year 2030 as a target date for the finalization of globalization, a cashless society and sustainability goals. This means that the elites have around ten years to create a crisis and then “solve” that crisis with globalism.

Ten years is a narrow window, and if the elites intend for conservatives to take the blame for the next crash, they will have to initiate it soon. They may not have a choice anyway, as the chain of dominoes was already been set in motion by the Fed in 2018 with its liquidity tightening policies.

We can also gauge timing of a collapse to a point by understanding the common tactics the establishment uses to hide what they are doing. Generally, when a collapse is about to accelerate the elites use crisis events as cover to distract the public and produce scapegoats. In my article ‘Globalists Only Need One More Major Event To Finish Sabotaging The Economy’, I outlined three potential distractions that could be used in the near term, and if any of these events took place, then people should watch for the collapse to move faster. Two of these events now appear imminent: The first being a war with Iran, and the second being a ‘No Deal’ Brexit.

Finally, we can take into account the globalist need for a scapegoat, and it appears that conservatives and nationalists are their target for blame. This leaves less than one year for a crisis event if Trump is intended to leave the White House in 2020, or less than four years if he is intended to stay in for a second term. Keep in mind that A LOT can happen in a single year, and a second Trump term is certainly not guaranteed yet.

But why create a collapse in the first place? Crash events allow the establishment to consolidate control over hard assets as poverty forces the population to sell what they have to survive. This poverty also creates fear, which makes the public malleable and easier to control. Each new crisis opens doors to political and social changes, changes which end in less freedom and more centralization. Collapse is a succession of crashes leading to a complete erasure of the original society. It’s not a Mad Max event, it’s a hidden and insidious cancer that takes over the national body and warps it into a wretched form. The collapse is complete when the nation either breaks apart, or is so damaged for so long that no one can remember what it used to look like.

What we are witnessing today is the beginning of a new crash, and the final phases of a collapse of our way of life. The economic boom narrative among conservatives is a farce designed to trick us into complacency. The bubble that we warned about under the Obama Administration has been popped under the Trump Administration. Nothing has changed in the ten years since the 2008 crash except that the motivation for keeping the crash hidden is quickly disappearing.

Crashes are inevitable, but collapse is only possible when the public remains unprepared. Our civilization and its values are under attack, but they can only be destroyed if we stay apathetic to the threat and refuse to prepare for their defense. We must adopt a philosophy of decentralization. We need localized and self sufficient economies, as well as a return to localized production. Beyond that, we have to prepare for the eventuality of a fight. The fate of the US economy has already been sealed, but the people who are destroying it can still be stopped before they use the collapse to force society into subservience. We have to offer security, we have to offer alternatives to the “new world order” and we have to remove the globalist threat permanently.

Make no mistake, we are living in the midst of an epoch moment; the outcome of collapse depends on us and our reactions. This is not the task of the next generation, it is a task for our generation. We do not have another couple of decades to take the danger seriously. The plates are not spinning, they have already dropped.