Authored by Lawrence Thomas via GoldTelegraph.com,

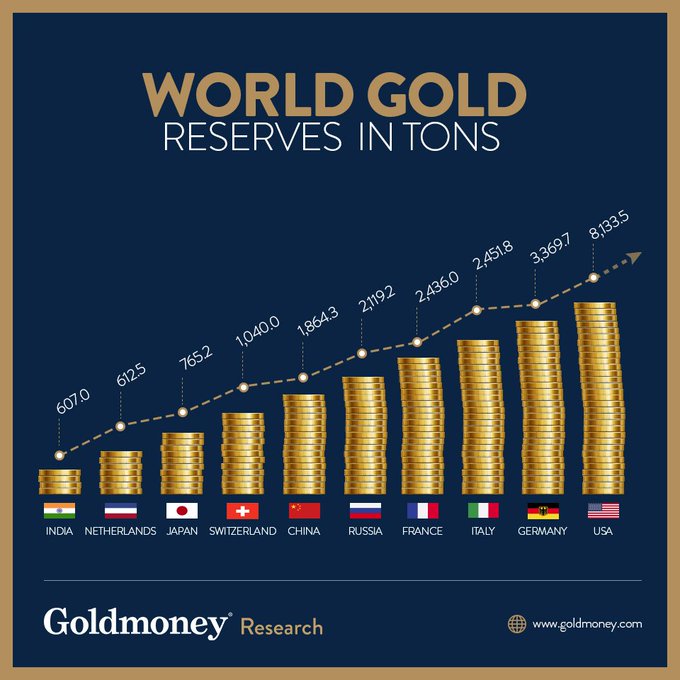

For almost a decade, global central banks have been avid gold buyers. Gold purchases by central banks in 2018 rose 36 percent over the previous year. Central banks are now holding 366 tons of the yellow metal. These gold purchases are the largest since 1971 when President Nixon ceased the gold standard and the tie between the U.S. dollar and gold, which rapidly led to the devaluation of the U.S. dollar.

Not every central bank has followed this trend. Venezuela, which is in the midst of an economic collapse, sold 25 tons of gold in 2018 in an attempt to repay its debts. But Venezuela is an exception. Other central banks are eager to increase their gold reserves as a hedge against economic uncertainty. Gold ownership by central banks is at a 50-year high as global purchases have increased 75 percent over the past year.

1. United States

The Federal Reserve holds the largest amount of gold of any other central bank, 8,133.5 tons. This is 75.2 percent of its foreign reserves. The Federal Reserve has not been as active in the gold-buying spree as other countries in an effort to keep the dollar from devaluing.

2. Germany

Germany’s central bank has been busy repatriating 674 tons of gold from the Banque de France and the Federal Reserve Bank. During the Cold War, the country’s closeness to what was then Russia-controlled East Germany drove Germany to store its gold with other countries. Now, the Deutsche Bundesbank is calling its gold back home. This move is expected to be completed by 2020. Germany currently holds 3,370.0 tons of gold, which account of over 70 percent of its foreign reserves. Germany, which experienced hyperinflation in the 1930s which saw the Deutschmark become valueless, has learned its history lesson.

3. Italy

Italy plans on holding on to its 2,451.8 tons of gold. The Bank of Italy has stated that it considers gold a safe investment in times of economic turmoil and a safeguard against the volatility of the U.S. dollar. Gold represents 67.9 percent of Italy’s foreign reserves.

4. France

France has gradually ceased selling its gold reserves in an effort to hold on to the 2,436.0 tons of gold it currently has. This amounts to over 60 percent of the country’s foreign reserves. Marine Le Pen, leader of the National Front Party, has advocated for a freeze on the sale of gold, as well as repatriation of all of France’s gold currently being held by foreign countries.

5. Russia

The Russian Central Bank has been bullish on gold for six years. In 2017, it overtook China to become the fifth largest holder of gold reserves. Much of this is due to trade tensions between the U.S. and Russia. Two years ago, Russia purchased 224 tons of gold and sold off much of its U.S. Treasury debts. This move is seen as a defensive effort to weaken the U.S. dollar as the top global reserve currency. Currently, Russia holds 2,119.2 tons of gold in reserves. The Russian Central Bank is leading the way in gold purchases in its efforts to devalue the dollar.

Since the U.S. placed economic sanctions against Russian, its central bank has been accumulating gold as a safety net against having its assets frozen. In 2018, it purchased 8.8 million ounces of gold.

6. China

China, which currently holds 1,864.3 tons of gold in reserve, a low amount among the leading gold-holding countries, but there have been many reports that the country has left some of the gold purchases off its books. However. China is expanding its reserves slowly. It is also the leading producer of gold in the world.

Global central banks now hold the greatest share of the world’s gold, approximately 33,800 tons. Gold has been a critical diversification tool, a safety hedge against inflation, or as collateral for loans.

Central banks in Austria and Switzerland have also indicated that they consider gold an essential reserve against future emergencies. The Polish central bank expressed the fact that their gold reserves allow diversification and greater independence and less reliance on the financial stability of other countries.

Sweden, Greece, and Portugal have expressed the same sentiments. Gold is a haven of safety during economic turndowns.

Goldmoney Research@GMoneyResearch

Countries have held #gold as a reserve asset throughout history…

Here are the top ten holders:

= 8,133.5

= 3,369.7

= 2,451.8

= 2,436.0

= 2,119.2

= 1,864.3

= 1,040.0

= 765.2

= 612.5

= 607.0

Is your country on the list?

#GoldmoneyResearch

2109:51 AM – Mar 28, 2019Twitter Ads info and privacy171 people are talking about this

The world’s central banks are counting on the power of gold to help them through bad economic times. Is this something investors should be thinking about, as well? The current economic growth experienced around the globe is expected to come to an end, as all economic upswings do. Some economists are predicting a recession by 2020. In the event of such an occurrence, investors should be position by having a proven hedge during bearing times.